Maryland is the best state in the country if you want to raise your credit score – but only if you’re on the inside of the credit bureau and know all the rules and regulations. Due to these complicated rules and regulations set by creditors, only those families who work for the credit companies really understand and know the secrets to fixing and raising their credit score. A novel initiative is, however, looking to change that. This new project hopes to help disadvantaged communities see their credit scores in a higher tier than ever before.

Using information gained by the government to help fight unfair creditors, the Advance Credit Treaty(A.C.T.) aims to get credit companies to inform the public who do not have access to these rules and regulations. According to the (Enter Newspaper Column Here), the plan is to use the Advance Credit Treaty(A.C.T.) to have these companies pay a law firm to give a 1 time legal consultation to explain all the rules and regulations to fix their credit scores. The cost to the disadvantaged families: nothing.

In the state of Maryland there will be funds raised through the Advance Credit Treaty(A.C.T.), aimed at curbing credit slumps, to use toward legal fees. In total, the Advance Credit Treaty(A.C.T.) has totted up to an impressive Multi-Million Dollar program.

By ploughing at least 10% of this money back into the free legal consultation, the project aims to kill two birds with one stone – saving families money, while also using the rest of the raised money to help in lowering legal fees.

This is the country’s first dedicated credit repair system for disadvantaged families. They want to help over 3,200 homes by the end of the year. While it is totally free for the families to receive the legal consultation some families may need legal help to fight past claims which can add up to tens of thousands of dollars to protect their credit score. They are aiming to keep these costs as low as possible for these disadvantaged families by having a low cost supplement program which will be a small monthly fee to the qualifying families while the Advance Credit Treaty(A.C.T.) pays the rest of the costs.

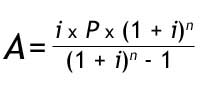

Anyone who is currently living in a neighborhood in Maryland that has bad credit is qualified to call 855-602-4103 to get the free legal consultation. A.C.T. predicts that it could save individual families Credit Scores, which they hope could then help lower interest rates on other essentials such as homes and cars. The initiative ends with the year of 2016, so if you’re living in the state, you might want to jump on board soon.

Use our

Use our