From the first decision to invest in real estate to actually buying your first rental property, there is a lot of work to be done. This task may be daunting for the first-time investor. Owning property is a tough business and the field is peppered with land mines that can obliterate your returns. Here we’ll take a look at the top 10 things you should consider when shopping for an income property.

Starting Your Search

Although you may want a real estate agent to help you complete the purchase of a rental property, you should start searching for your investment on your own. Having an agent can bring unnecessary pressure to buy before you have found a property that suits you. The most important thing is to take an unbiased approach to all the properties and neighborhoods within your investing range.

Your investing range will be limited by whether you intend to actively manage the property (be a landlord) or hire someone else to manage it. If you intend to actively manage, you should not get a property that’s too far away from where you live. If you are going to get a property management company to look after it for you, your proximity to the property will be less of an issue.

Let’s take a look at the top 10 things you should consider when searching for the right rental property.

- Neighborhood: The quality of the neighborhood in which you buy will influence both the types of tenants you attract and how often you face vacancies. For example, if you buy in a neighborhood near a university, the chances are that your pool of potential tenants will be mainly made up of students and that you will face vacancies on a fairly regular basis (during summer, when students tend to return back home).

- Property Taxes: Property taxes are not standard across the board and, as an investor planning to make money from rent, you want to be aware of how much you will be losing to taxes. High property taxes may not always be a bad thing if the neighborhood is an excellent place for long-term tenants, but the two do not necessarily go hand in hand. The town’s assessment office will have all the tax information on file or you can talk to homeowners within the community.

- Schools: Your tenants may have or be planning to have children, so they will need a place near a decent school. When you have found a good property near a school, you will want to check the quality of the school as this can affect the value of your investment. If the school has a poor reputation, prices will reflect your property’s value poorly. Although you will be mostly concerned about the monthly cash flow, the overall value of your rental property comes in to play when you eventually sell it.

- Crime: No one wants to live next door to a hot spot for criminal activity. Go to the police or the public library for accurate crime statistics for various neighborhoods, rather than asking the homeowner who is hoping to sell the house to you. Items to look for are vandalism rates, serious crimes, petty crimes and recent activity (growth or slow down). You might also want to ask about the frequency of police presence in your neighborhood.

- Job Market: Locations with growing employment opportunities tend to attract more people – meaning more tenants. To find out how a particular area rates, go directly to the U.S. Bureau of Labor Statistics or to your local library. If you notice an announcement for a new major company moving to the area, you can rest assured that workers will flock to the area. However, this may cause house prices to react (either negatively or positively) depending on the corporation moving in. The fallback point here is that if you would like the new corporation in your backyard, your renters probably will too.

- Amenities: Check the potential neighborhood for current or projected parks, malls, gyms, movie theaters, public transport hubs and all the other perks that attract renters. Cities, and sometimes even particular areas of a city, have loads of promotional literature that will give you an idea of where the best blend of public amenities and private property can be found.

- Building Permits and Future Development: The municipal planning department will have information on all the new development that is coming or has been zoned into the area. If there are many new condos, business parks or malls going up in your area, it is probably a good growth area. However, watch out for new developments that could hurt the price of surrounding properties by, for example, causing the loss of an activity-friendly green space. The additional condos and/or new housing could also provide competition for your renters, so be aware of that possibility.

- Number of Listings and Vacancies: If there is an unusually high number of listings for one particular neighborhood, this can either signal a seasonal cycle or a neighborhood that has “gone bad.” Make sure you figure out which it is before you buy in. You should also determine whether you can cover for any seasonal fluctuations in vacancies.Similar to listings, the vacancy rates will give you an idea of how successful you will be at attracting tenants. High vacancy rates force landlords to lower rents in order to snap up tenants – low vacancy rates allow landlords to raise rental rates.

- Rents: Rental income will be the bread and butter of your rental property, so you need to know what the average rent in the area is. If charging the average rent is not going to be enough to cover your mortgage payment, taxes and other expenses, then you have to keep looking. Be sure to research the area well enough to gauge where the area will be headed in the next five years. If you can afford the area now, but major improvements are in store and property taxes are expected to increase, then what could be affordable now may mean bankruptcy later.

- Natural Disasters: Insurance is another expense that you will have to subtract from your returns, so it is good to know just how much you will need to carry. If an area is prone to earthquakes or flooding, paying for the extra insurance can eat away at your rental income.

Getting Information

Talk to renters as well as homeowners in the neighborhood. Renters will be far more honest about the negative aspects of the area because they have no investment in it. If you are set on a particular neighborhood, try to visit it at different times on different days of the week to see your future neighbors in action.

The Physical Property

In general, the best investment property for beginners is a residential, single-family dwelling or a condominium. Condos are low maintenance because the condo association is there to help with many of the external repairs, leaving you to worry about the interior. Because condos are not truly independent living units, however, they tend to garner lower rents and appreciate more slowly than single-family homes. (For more insight, read An Introduction to Buying A Condominium and Does Condo Life Suit You?)

Single-family homes tend to attract longer-term renters in the form of families and couples. The reason families, or two adults in a relationship, are generally better tenants than one person is because they are more likely to be financially stable and pay the rent regularly. This owes to the simple fact that two can live almost as cheaply as one (as far as food, rent and utilities go) while still enjoying dual income. As a landlord, you want to find a property and a neighborhood that is going to attract that type of demographic.

When you have the neighborhood narrowed down, look for a property that has appreciation potential and a good projected cash flow. Check out properties that are more expensive than you can afford as well as those within your reach – real estate can often sell below its listing price. Watch the listing prices of other properties and ask buyers about the final selling price to get an idea of what the market value really is in the neighborhood. For appreciation potential, you are looking for a property that, with a few cosmetic changes and some renovations, will attract tenants who are willing to pay out higher rents. This will also serve you well by raising the value of the house if you choose to sell it after a few years.

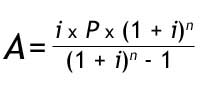

As far as cash flow, you are going to have to make an informed guess. Take the average rent for the neighborhood and subtract your expected monthly mortgage payment, property taxes (divided by 12 months), insurance costs (also divided by 12) and a generous allowance for maintenance and repairs. Don’t lie to yourself and underestimate the cost of maintenance and repairs or you will pay for it once the deal is done. If all these figures come out even or, better yet, with a little left over, you can now get your real estate agent to submit an offer and, if everything goes well, order business cards with Landlord emblazoned across the top.

The Bottom Line

Every state has good cities, every city has good neighborhoods and every neighborhood has good properties, but it takes a lot of footwork and research to line up all three. When you do find your ideal rental property, keep your expectations realistic and make sure that your own finances are in a healthy enough state that you can wait for the property to start producing cash flow rather than needing it desperately. Real estate investing doesn’t start with buying a rental property – it begins with creating the financial situation where you can buy a rental property.

Everybody deserves access to unbiased investment advice. That’s why FutureAdvisor has made their investment algorithms available for public use. You can link your investments to their algorithms and receive a personalized, step by step action plan to help improve your portfolio. Their advice is 100% free – always. Set up your free account today – it only takes 2 minutes to get started.

Use our

Use our